Introduction: Demystifying the MACD

The Moving Average Convergence/Divergence (MACD) is one of the most widely used and enduring tools in the arsenal of technical analysts. Created nearly five decades ago, its continued relevance is a testament to its effectiveness in a variety of market conditions. At its core, the MACD is a versatile indicator designed to help traders identify price trends, measure the momentum behind those trends, and spot potential reversals. Its value lies in its simplicity and clarity, providing actionable buy and sell signals that can be interpreted by both novice and seasoned traders. This report serves as a definitive guide, moving from the foundational principles to advanced applications, empowering modern traders with a deeper understanding of this powerful indicator.

Chapter 1: The Origins and Anatomy of MACD

1.1 What is Moving Average Convergence/Divergence?

The MACD is classified as a trend-following momentum oscillator, yet it differs from typical oscillators like the Relative Strength Index (RSI) in that it lacks defined upper or lower boundaries. Its primary purpose is to illustrate the relationship between two Exponential Moving Averages (EMAs) of a security’s price. The term “convergence” refers to the tendency of the two moving averages to move closer together as momentum slows, while “divergence” signifies that they are moving apart as momentum accelerates. This simple yet profound relationship is the fundamental principle that drives the entire indicator’s logic. By plotting the difference between a faster (short-term) EMA and a slower (long-term) EMA, the MACD provides a dynamic measure of the market’s underlying momentum, helping traders to “see” the trend through the noise of daily price fluctuations.

1.2 The Mind Behind the Method: Gerald Appel’s Legacy

The Moving Average Convergence/Divergence indicator was developed by Gerald Appel in the late 1970s. Appel, a respected figure in the financial world, founded the investment newsletter

Systems and Forecasts in 1973 and authored 17 investment books. He also managed client money for over 35 years before his retirement in 2012. Appel’s foundational belief was that to achieve trading success, it was essential to measure the momentum driving a trend. He recognized that while moving averages are effective at illustrating trends, market volatility and price fluctuations can often obscure the true “underlying” trend. The MACD was his solution, designed to reveal changes in the strength, direction, momentum, and duration of a security’s price trend. This innovative tool remains a cornerstone of technical analysis more than 40 years after its creation, a testament to its enduring utility and a key part of Appel’s legacy.

Chapter 2: The Mechanics of MACD: Components and Calculation

The MACD indicator is a collection of three interconnected time series, each playing a distinct role in generating its trading signals. Understanding these components and their relationship is crucial for effective analysis.

2.1 The Three Essential Components

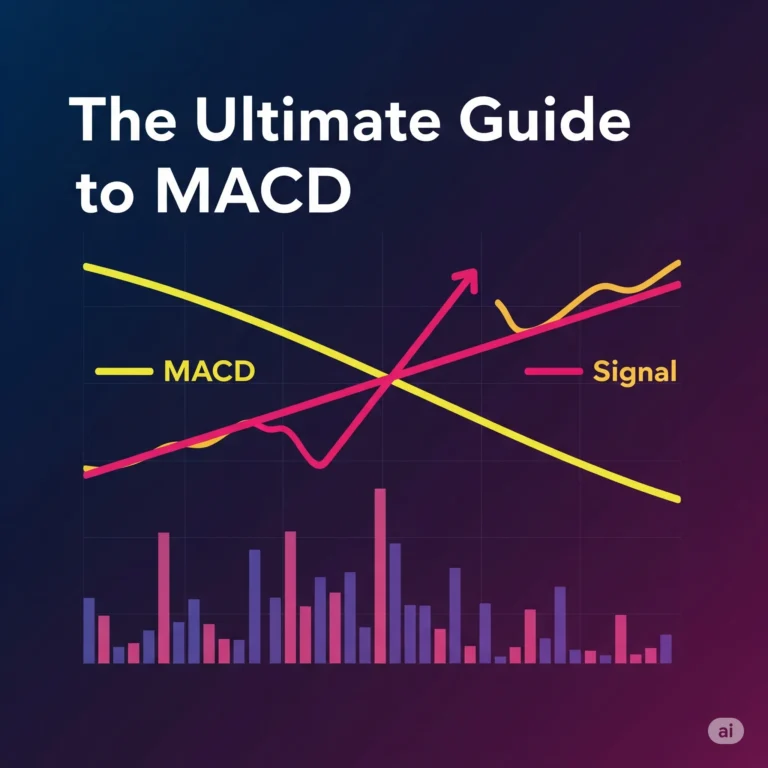

- The MACD Line: This is the core of the indicator. It is the result of subtracting a longer-period EMA from a shorter-period EMA. The standard parameters are the 12-period and 26-period EMAs, and the MACD line reflects the changes in the momentum of the asset’s price. When the MACD line is positive, it means the short-term EMA is above the long-term EMA, indicating bullish momentum. A negative MACD line signals the opposite, with the short-term EMA below the long-term one, pointing to bearish momentum.

- The Signal Line: This is a 9-period EMA of the MACD line itself. Plotted directly on top of the MACD line, its purpose is to “trail” the MACD line, providing a smoothed-out average of recent momentum. It acts as a trigger line, and its crossovers with the MACD line are the most common source of trading signals.

- The MACD Histogram: The histogram is a bar chart that visually represents the difference between the MACD line and the signal line. The bars are positive (above the zero line) when the MACD line is above the signal line, indicating increasing bullish momentum. Conversely, the bars are negative (below the zero line) when the MACD line is below the signal line, showing increasing bearish momentum. The height of the histogram bars is a direct representation of the strength of this momentum.

The MACD line measures the momentum, but the histogram measures the rate of change of that momentum. A rising histogram signifies that momentum is accelerating in the direction of the trend, while a shrinking histogram suggests that momentum is decelerating, foreshadowing a potential reversal or a future crossover. This visual representation allows traders to anticipate a momentum shift before it is confirmed by the lines crossing, adding a critical layer of analysis.

2.2 The Formula Simplified

For a WordPress blog audience, the formulas for the MACD are best presented in a simple, straightforward manner.

- MACD Line = (12-period EMA) – (26-period EMA)

- Signal Line = (9-period EMA of the MACD Line)

- MACD Histogram = (MACD Line) – (Signal Line)

It is important to understand that the MACD relies on Exponential Moving Averages (EMAs) rather than Simple Moving Averages (SMAs). An EMA places greater weight and significance on the most recent data points, making the indicator more responsive to recent price changes than a traditional SMA.

A key and often overlooked connection is the relationship between the MACD line and the zero line. When the MACD line crosses the zero line, it is mathematically identical to the 12-period EMA crossing the 26-period EMA. This is because the MACD line is calculated as the difference between these two EMAs. For the MACD line to be zero, the two EMAs must be equal, which only occurs at the point of a crossover. This observation reinforces that the zero-line crossover is not just a secondary signal, but a direct representation of a core moving average crossover, a classic trend-following strategy in itself.

A visual representation of the key components and their functions is provided in the following table:

| Component | Formula | Standard Parameters | Function |

| MACD Line | 12-period EMA – 26-period EMA | 12, 26 | Measures momentum and reflects changes in price |

| Signal Line | 9-period EMA of MACD Line | 9 | A smoothed version of the MACD Line that acts as a buy/sell trigger |

| MACD Histogram | MACD Line – Signal Line | N/A | Visually represents the distance and momentum difference between the two lines |

Chapter 3: Interpreting MACD Signals for Trading

The MACD generates a variety of signals that can be used to identify potential trading opportunities. The three most common interpretations are crossovers, divergences, and the zero-line cross.

3.1 The Crossover Conundrum

- Signal-Line Crossovers: This is the most common MACD trading signal. A bullish crossover occurs when the MACD line rises and crosses above the signal line. This is widely interpreted as a buy signal, as it suggests that short-term momentum is now leading long-term momentum to the upside. Conversely, a bearish crossover happens when the MACD line crosses below the signal line, triggering a sell or short signal and indicating a shift in momentum to the downside. While these crossovers are clear and easy to spot, they can produce frequent false signals, or “whipsaws,” especially in non-trending or volatile markets.

- The Zero-Line Crossover: A zero-line crossover is often seen as a more significant signal than a signal-line crossover because it indicates a major shift in the underlying trend itself. A bullish zero-line crossover occurs when the MACD line crosses from negative to positive territory. This indicates that the short-term EMA (12-period) has moved above the long-term EMA (26-period), confirming a shift to a bullish trend. A bearish zero-line crossover occurs when the MACD line crosses below the zero line, signaling that the 12-period EMA has fallen below the 26-period EMA and confirming a shift to a bearish trend. Zero-line crossovers can be powerful but are often lagging and may lead to a late entry into a new trend.

3.2 The Power of Divergence

Divergence is a more advanced trading technique that highlights a potential trend reversal before it occurs. Divergence is a disagreement between the price action of a security and the movement of the MACD indicator. This indicates that the momentum behind the price movement is weakening, even if the price itself continues its current trajectory.

- Bullish Divergence: This occurs when a security’s price makes a new low, but the MACD indicator fails to make a new low, instead making a higher low. This suggests that even though the price is falling, the selling momentum is decreasing, foreshadowing a potential bullish reversal and a buying opportunity.

- Bearish Divergence: This occurs when the price of a security makes a new high, but the MACD indicator fails to make a new high, instead making a lower high. This indicates that the buying momentum is weakening, which may signal an impending bearish reversal and a selling opportunity.

It is important to view divergence as a warning sign rather than a definitive trading signal. False signals are common, and the reversal may be delayed or may not happen at all. The true value of a divergence signal is that it prompts the trader to prepare for a potential trend change and to look for other confirming signals before acting on the information. This is a crucial distinction that separates a basic understanding of the indicator from an expert-level application.

A summary of the main MACD signals is presented in the following table:

| Signal Type | Condition | Interpretation |

| Bullish Signal Crossover | MACD Line crosses above Signal Line | Bullish Signal, indicates increasing upside momentum |

| Bearish Signal Crossover | MACD Line crosses below Signal Line | Bearish Signal, indicates increasing downside momentum |

| Bullish Zero-Line Crossover | MACD Line crosses above the zero line | Confirms a shift from a bearish to a bullish trend |

| Bearish Zero-Line Crossover | MACD Line crosses below the zero line | Confirms a shift from a bullish to a bearish trend |

| Bullish Divergence | Price makes lower lows, MACD makes higher lows | Potential bullish reversal as selling momentum is waning |

| Bearish Divergence | Price makes higher highs, MACD makes lower highs | Potential bearish reversal as buying momentum is waning |

Chapter 4: The Balanced View: Pros, Cons, and Context

Like any technical indicator, the MACD is not perfect. A comprehensive understanding requires a balanced view of its advantages and its inherent limitations.

4.1 The Advantages of Using MACD

The primary advantage of the MACD is its dual nature as both a trend and momentum indicator. This allows it to provide multiple layers of insight, helping traders identify the direction and strength of a trend with clear, actionable signals. Its signals—including crossovers, zero-line crosses, and divergences—are straightforward to interpret, making it accessible to traders of all experience levels. A rising MACD indicates accelerating upside momentum, while a falling MACD shows accelerating downside momentum, providing a quick visual cue as to the market’s current state. Furthermore, the indicator is highly customizable, and its parameters can be adjusted to suit different securities, trading styles, and timeframes.

4.2 The Inherent Limitations

The most significant limitation of the MACD is its lagging nature. As an indicator based on moving averages, it follows, rather than anticipates, price action. This can lead to delayed signals, causing a trader to enter a trend late and potentially miss a significant portion of the move. The indicator is also notoriously ineffective in sideways or range-bound markets. In such conditions, the MACD line and signal line may oscillate back and forth across the zero line, producing frequent, inaccurate, and confusing “whipsaw” signals that can lead to losing trades.

A reversal signal generated by the MACD, such as a divergence or crossover, is not a guarantee of a trend change and can be a false positive. Without confirmation from other indicators or price action, trading on a single MACD signal is a risky proposition. Finally, unlike indicators like the RSI, the MACD lacks concrete overbought or oversold levels. While extreme high or low values on the MACD histogram may suggest a market is becoming overextended, these levels are relative and must be judged by visual comparison to the indicator’s past performance.

Chapter 5: Putting MACD into Practice: Advanced Strategies and Confirmation

To overcome the inherent limitations of the MACD, expert traders rarely use it in isolation. Instead, they combine it with other forms of analysis to confirm signals and increase the probability of a successful trade.

5.1 The Confluence of Indicators: MACD + RSI

Combining the MACD with the Relative Strength Index (RSI) is a common and effective strategy. The power of this combination lies in using each indicator for its specific strengths: the MACD for identifying the overall trend and momentum, and the RSI for pinpointing temporary overbought and oversold conditions. A sophisticated approach involves a multi-timeframe strategy.

The first step is to use the MACD on a higher timeframe (e.g., a daily chart for a swing trader) to establish a “trend filter”. For example, a trader would only look for buy opportunities when the MACD line is above the signal line and the histogram is positive. Once a bullish trend is confirmed on this higher timeframe, the trader would then drop to a lower timeframe (e.g., a 4-hour chart) and use the RSI to time their entry. The entry signal would be triggered when the RSI moves from an oversold state (below 30 or 40) back above that threshold, which is a sign of a short-term pullback ending within the broader uptrend. The exit strategy would be to close the position when the RSI moves into overbought territory (above 70) or when the MACD histogram on the higher timeframe begins to shrink, signaling a loss of momentum. This dual-confirmation approach leverages the lagging nature of MACD as a filter and uses the RSI to identify optimal entry points on corrections, significantly reducing the occurrence of false signals.

5.2 Trading with Market Structure: MACD + Support & Resistance

Another powerful way to confirm MACD signals is by trading in the context of market structure, specifically at major support and resistance levels. When a MACD signal coincides with a key price level, it creates a powerful “confluence of signals” that greatly increases its reliability. For example, a bullish divergence on the MACD, which is a potential buy signal, becomes a much stronger one if it occurs precisely at a major support level that has historically held prices. This confluence of an indicator signal and a price-based level of technical significance acts as a critical risk filter, reducing the probability of trading on a false signal. It’s also worth noting that the zero line on the MACD chart itself can sometimes act as a psychological support or resistance level for the indicator’s value, which can provide additional context.

5.3 MACD + Candlestick Patterns

For even greater precision, traders can use candlestick chart patterns to corroborate MACD signals. Candlestick patterns are a form of price action analysis that can signal a potential reversal or continuation of a trend. For example, a trader might first spot a bullish MACD divergence as an early warning that selling momentum is fading. The trader would then wait for a bullish reversal candlestick pattern, such as a morning star or a bullish engulfing pattern, to appear at a key support level. The appearance of the candlestick pattern provides a precise timing trigger for the trade, validating the momentum shift shown by the MACD. This synergy between the MACD’s early warning of a potential trend change and the candlestick pattern’s precise entry signal provides a high-confidence trade setup.

5.4 Customizing MACD Settings

While the standard 12, 26, and 9 periods are the most common, they are not mandatory. The standard settings were designed for daily charts and may not be optimal for every trading style or security. Day traders, for example, may prefer to use faster settings, such as (8, 17, 9) or (5, 13, 1), to capture more frequent and rapid momentum shifts on shorter timeframes. Conversely, long-term investors or swing traders might use slower settings to filter out short-term market noise and focus on major trend changes. It is paramount that any adjusted settings are thoroughly backtested to ensure they are effective for a specific trading strategy and asset before being applied in live trading.

Conclusion: The MACD as a Tool, Not a Crystal Ball

The Moving Average Convergence/Divergence (MACD) indicator, a legacy of Gerald Appel’s influential work, remains one of the most powerful and versatile tools in technical analysis. It effectively identifies trends, measures momentum, and generates actionable signals through crossovers, divergences, and zero-line crosses. However, its true value is not found in its signals alone, but in its strategic application within a comprehensive trading plan.

As a lagging indicator, the MACD is susceptible to false signals and is most effective in trending markets. A fundamental principle of modern technical analysis is that no single indicator should be used in isolation. The most successful traders use the MACD in conjunction with other forms of analysis to confirm its signals and mitigate risk. Combining it with an oscillator like the RSI on a multi-timeframe basis, observing its signals in the context of key support and resistance levels, and waiting for confirmation from a price action-based tool like a candlestick pattern are all strategies that significantly enhance the MACD’s reliability. Ultimately, the MACD is not a crystal ball for predicting future price movements but rather a finely tuned instrument for measuring market momentum. When used as a foundational element within a holistic trading framework, and complemented by sound risk management practices, it becomes an indispensable tool for navigating the complexities of the financial markets.